High-Energy Corporate Speaker

& Sales Development Leader

WATCH TO LEARN MORE ABOUT OUR MISSION, HOW WE TRANSFORM LIVES

If You’re Tired of Watching Team Potential Sit on the Sidelines...

You're not alone — Get your Team To Call The Damn Leads

Meet Drewbie Wilson

Drewbie Wilson is a husband, father, and entrepreneur who turned tattoos, tenacity, and a phone full of leads into a multi-million-dollar brand.

He’s the founder of Call The Damn Leads® and the author of four powerhouse books—Crushing The Day, Social Media Mastery, Diary of a Damn Closer, and the flagship Call The Damn Leads.

Drewbie has helped thousands of entrepreneurs, sales pros, and business leaders master the mindset, systems, and daily habits that drive success.

His no-Nonsense, high-energy message blends real-life storytelling, battle-tested systems, and authentic inspiration that move audiences to action.

Whether he’s on stage, on camera, or behind the mic—Drewbie’s mission stays the same: To help people Call The Damn Leads, and crush the day before it crushes You.

Why Audiences Love Drewbie

Speaks The Truth Their Team Needs To Hear

Paints A Clear Picture Of What Success Looks Like

Creates Energy You Can Feel In The Room

Delivers A Message That Resonates And Sticks

Turns Motivation Into Measurable Action

Brings Real-World Sales Experience You Can Trust

Most Importantly:

Drewbie’s not here to hype you up for a few hours... he’s here to change the way you think, act, and execute.

Signature Keynote/Training

Can Be Delivered In Person or Online

Call The Damn Leads

The Answer To All Your Money Problems...

In this keynote, Drewbie uncovers the untapped potential in every area of life and business. He shares innovative time management and follow-up systems that turn cold calls into warm conversations and, eventually, profitable conversions.

Perfect for: sales teams, entrepreneurs, and organizations ready to increase revenue through consistent action.

Attendees will learn:

- The daily disciplines that drive consistent results.

- How to transform lead lists into booked calls and closed deals.

- Why action, persistence, and follow-up are the real money multipliers.

Other Available Keynotes:

Leads Don't Suck, Your Follow Up Does...

How To Make F-U Money In Sales!

In this powerful session, Drewbie teaches how to build a follow-up process centered on service, not spam. He breaks down how to nurture relationships that add value, build trust, and convert more opportunities.

Perfect for: business owners and teams who want predictable sales.

Attendees will learn:

- The “Call, Serve, Profit” framework that creates raving fans, not just customers.

- How to automate follow-up without losing the human touch.

- The mindset shift that turns “sales” into service.

Millions From Memes

Discovering The Value Of Social Trends And Using Them To Sell More Of Your Stuff!

This keynote takes audiences inside the viral world of Closer Memes, showing how humor and relatability can become strategic sales assets. Drewbie shows how memes can warm up cold leads, reignite conversations, and drive engagement that actually converts.

Perfect for: marketing teams, digital entrepreneurs, and anyone wanting to make sales fun again.

Attendees will learn:

- How to use humor to connect and convert.

- Why storytelling and authenticity outperform “perfect” branding.

- The psychology of content that sells without selling.

Social Media Mastery

How Busy Sales Professionals Can Generate Millions of Impressions Online for Free

Drewbie shares the blueprint behind his Social Media Mastery framework that’s helped entrepreneurs dominate organic reach and turn attention into income.

Perfect for: business owners, service providers, and content creators.

Attendees will learn:

- The exact content rhythm that builds trust and traffic.

- How to create consistent, scroll-stopping posts that lead to conversations.

- Ways to grow your brand’s reach without wasting a single ad dollar.

Who Should See This

This Presentation is for you & Your Team if:

You lead an Agency, sales team, or brokerage ready to perform at a higher level

You’re tired of repeating the same message and want it to finally click

You’ve got talented agents who’ve lost their fire and need it reignited

You know your team could be making more calls, closing more deals, and serving more clients

You want someone who can back up motivation with systems that actually move the needle

You’re looking for a speaker who connects, challenges, and converts inspiration into action

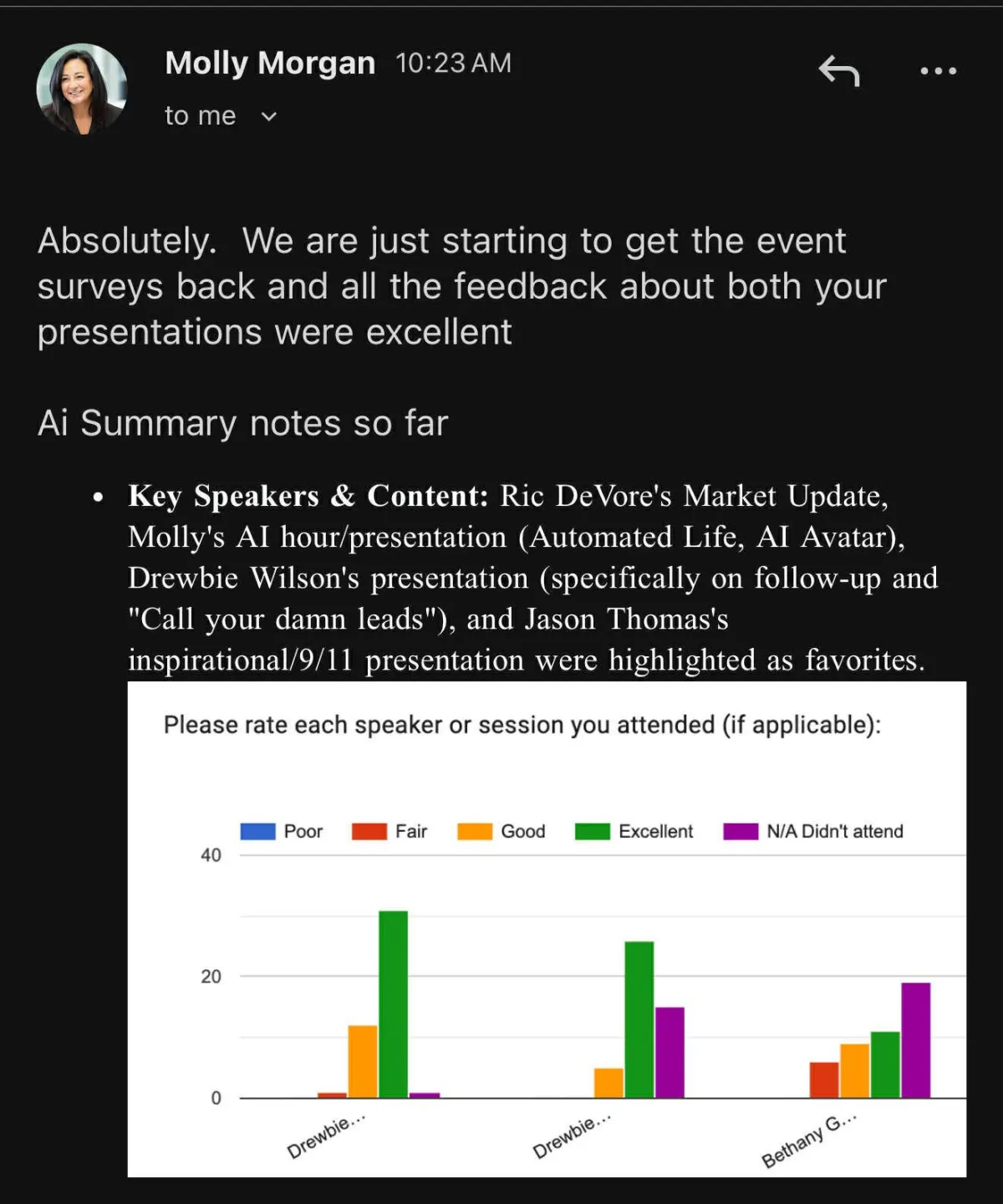

Molly Morgan

- E-Merge Real Estate Team -

More On The Books Drewbie Has Written...

Call The Damn Leads

Most sales books give you theory. This one gives you a system that works. No fluff, no filler - just straight-talking guidance that turns reluctant prospectors into confident closers. Every page delivers real-world tactics you can use today to boost your numbers tomorrow.

The winning mindset that makes prospects want to continue the conversation

A proven framework that eliminates phone anxiety and turns cold calls into natural

Why traditional sales scripts fail - and how to have authentic conversations that convert

The C.A.L.L.S Framework and how it drives higher engagement rates with every call

Diary of a Damn Closer

Every missed opportunity costs you money. Whether you're making calls from your desk or closing deals on the go, this digital guide keeps your focus sharp and your momentum building. Track what matters, measure what works, and watch your numbers climb.

A proven accountability system that pushes you past your comfort zone daily

The exact blueprint successful closers use to build their dream life step by step

How to track and measure your efforts to maximize return on every ad dollar spent

The strategies that help you value your time properly and earn what you deserve

The "All-In Contract" that transforms good intentions into consistent results

Social Media Mastery

Turn Every Post Into a Prospect Magnet.

Build real connections online

Create content that converts without spending a dime

Stay top-of-mind in your market using authenticity and repetition

Crushing The Day

Mindset & Habits of Top Producers.

Rewire your morning routine for unstoppable energy.

The exact blueprint successful closers use to build their dream life step by step

Build consistency through gratitude and structure.

Crush The Day Before It Crushes Your!

Ready To Light A Fire Under Your Team?

You’ve built a great team.

Now it’s time to give them the spark that gets them moving again.

Drewbie’s live keynotes bring the perfect mix of energy, humor, and hard truth that sales teams need to hear.

He doesn’t just inspire — he activates.

Every event ends with your people fired up, focused, and following through.

Whether you’re leading a real estate office, brokerage, or sales organization, this is your chance to turn motivation into measurable movement.

Lets talk about your event

Tell me about your audience and goals. I’ll suggest the best format,

tailor the content, and make it easy to host a high-impact session.

Frequently Asked Questions

Need more info? You can find it here.

What Can We Expect From Drewbie’s Keynote?

A high-energy, no-fluff experience that gets your team thinking, laughing, and taking action. Drewbie mixes storytelling, real-world sales strategies, and audience interaction to create momentum that lasts long after the event.

Is This Just Motivation Or Real Strategy?

Both. Drewbie inspires your people to move—but he also gives them proven systems and frameworks they can use immediately to make more calls, close more deals, and create consistent results.

How Long Are The Keynotes And Can They Be Customized?

Most keynotes run between 45 and 90 minutes, depending on your event schedule. Each one is fully customized to your industry, your team’s challenges, and the outcomes you want to see.

®️Call The Damn Leads - A Crushing The Day Company. All Rights Reserved. 2026

📧 Contact Us | Privacy Policy 📃

This site is not a part of the Meta™ website or Meta™ Platforms, Inc. Additionally, this site is NOT endorsed by Meta™ in any way. Meta™ is a trademark of Meta™ Platforms, Inc.

DISCLAIMER: The sales figures stated on this page and discussed in the training curriculum are our personal sales figures and in some cases the sales figures of previous or existing clients. Please understand these results are not typical. We’re not implying you’ll duplicate them (or do anything for that matter). The average person who buys “how to” information gets little to no results. We’re using these references for example purposes only. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT PURCHASE FROM CALL THE DAMN LEADS.